Home page

» ECONOMY

» Budget system of Azerbaijan Republic

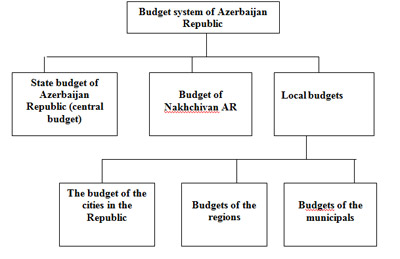

Budget system of Azerbaijan RepublicBudget system of Azerbaijan Republic consists of the state budget of Azerbaijan Republic, Budget of the Nakhchivan Autonomous Republic, and local budgets. The budget system is based on the independence and operation of budgets included into the system on the common principles. The unity of the budget system is based on the interaction of budgets by using regulatory sources of profit, establishing targeted budget funds, and distributing financial resources among budgets of various levels. The unity of the budget system is ensured by using the same budget classification, budget documents and forms, by preparing regular report and summary budget reports concerning budget implementation, and by submitting in the form defined by legislation. In compliance with the legislation, the independence of the budgets is determined by the fact that they are entitled to determine the courses of profit resources and expenditures in the framework of unified budget classification. The object of state budget of Azerbaijan Republic is to solve the economic, social, and other strategic programs and problems of the country, to ensure the collection and effective use of financial funds for the exercise of state functions as defined by legislation. The state budget of Azerbaijan Republic consists of centralized incomes and expenditures, local incomes and expenditures. The local budget is the financial funds established and used to realize the principle of self-government in compliance with the municipal status and to exercise the authority of the municipals defined by the Constitution and legislations of Azerbaijan Republic. The composition and exercise of local budget is conducted on the basis common principles defined by the legislation of budget system and in accordance with the budget classification used in Azerbaijan Republic. The scheme of budget system in Azerbaijan Republic:  The following charter reflects the exact resources of profits of the State Budget:

|